Have Type 1 Diabetes?

Know someone who does?

Heading

Heading

Heading

Apply now for your guaranteed* Disability Tax Credit (DTC) Approval with Canadian Disability Tax Credit Institute (CDTCI).

The federal and provincial governments now support DTC's for Type 1 (T1) Diabetics; however, they won't chase you down to make sure you apply and claim your benefits.

You must initiate the DTC application.

Why choose CDTCI?

The tragedy is most T1 Diabetics are NOT getting their DTC and missing out on thousands of dollars each year! Don't YOU be one of them.

CDTCI gets you approved.

As of June 24, 2022 all Canadians living with T1 diabetes may automatically qualify for the DTC but only if you follow Canada Revenue Agency (CRA) instructions perfectly. Further, the new requirements will apply only to the 2021 tax year and onwards – it is not retroactive to prior years.

Our Guarantee*

We guarantee you will be approved for your T1 DTC for 2021 and 2022 and beyond or your money will be unconditionally refunded. Period!

No Hidden Costs

Our fee for getting your 2021 and 2022 DTC's is a flat, very low, one-time fee. Plus you will continue to benefit from our efforts every tax year forward at absolutely no extra cost to you. Read our FAQ to find out more. A one-time fee for a lifetime of benefits!

Fast Turnaround

CDTCI has perfected the process. From the moment you give us the okay to start your application, our case officers will dutifully manage and monitor your progress through the CRA and medical professional maze right up to your DTC approval. We are there for you after as well.

Brains, Talent and a HUGE amount of Effort

Brains, talent and a HUGE amount of effort, that's what you get with CDTCI. While we are a small, efficient team, some family, some awesome people who have worked with us in the past and a few peeps who found us through very kind words of mouth, you can be assured that we are working for you. Both the CRA and medical profession can be challenging to deal with, yet most are great people. We just know how to work through the obstacles and egos to make sure you get what you deserve.

Don't Trust CRA to Handle Your Retroactive DTC Claim Fairly

If you wish to benefit retroactively from the DTC for the years of living with diabetes prior to 2021, you will have to complete the form and justify that you meet the old, onerous requirements (14 hours/week minimum). This is not easy to do and more often than not CRA will reject on an arbitrary, ad hoc and deceitful basis. Without our expertise your success is doubtful! Just watch this short clip from CBC with Kim Hanson from Diabetes Canada outing CRA in a Big Lie in 2017 to understand the difficulties in dealing with CRA. It is and was abominable!

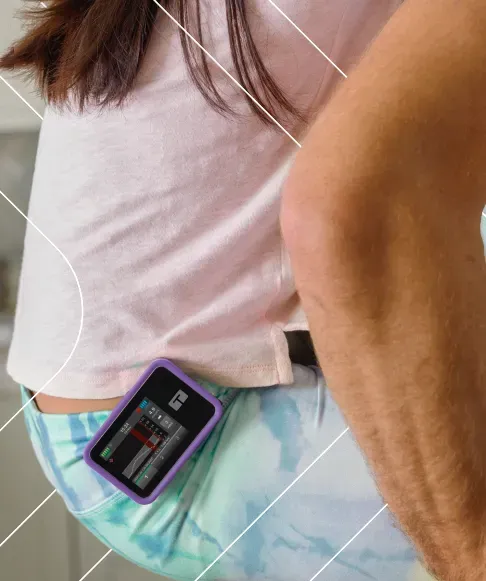

Whether you take multiple daily injections...

How we get YOU approved.

Full disclosure: Yes, you can do this on your own, but like everything, if you only ever do it once, you can really never master it. Do you want to risk being declined or delaying your DTC due to a simple filing error, your doctor not completing a form to the satisfaction of CRA, not knowing who to reach out to regarding a question or mitigating circumstance, not having the time for tenacious follow up and oversight? That's where we come in.

Step #1

Get In Touch

Click GET IN TOUCH. Answer a few very simple questions (i.e., do you have T1 Diabetes, year of diagnosis, etc.) and provide some personal information. If we determine you are eligible, simply say YES and let us start the process together straight away.

Step #2

The Application

We complete all necessary (CRA) and medical forms for your approval and for signatures. CDTCI follows a rigorous oversite, review and necessary follow up process prior to submitting your application to CRA to ensure the highest likelihood of success.

Step #3

The Follow Up

Throughout the entire process, we will communicate with your medical team of professionals, CRA and even your accountant, if needed, to ensure your file is approved. Our experience, research, knowledge, attention to detail and tenacity ensure your success. Guaranteed!

About Our Founder

A fighter with a smile, Tom was diagnosed with T1 diabetes on February 8, 1977. He has witnessed a lifetime of improvements and changes in how diabetes is managed and accepted. Always cognizant of his A1C's (tough but rewarding work) and pushing for better overall blood sugar control, he recently switched to a Tandem Insulin Pump along with Dexcom G6, leaving multiple daily injections behind for the first time since diagnosed. Having recently "retired" and spending most spring, summer and fall days on the golf course, low blood sugars were becoming a real issue so he switched to the pump and never looked back!

Around that time, Tom also asked his former endo to support a DTC application given all the reading, research and advocating Tom had been doing over the years. Surprisingly, his endo outright refused to entertain an application citing various reasons: the large amount of work required for the application; the "fact" he would most likely not get approved, claiming CRA was arbitrarily denying T1 DTC applications; he did not think a T1 could justify 14 hours per week to fulfil the DTC requirement. Hmmm. Tom disagreed and set to work, yet still tries to golf most days during the Ontario golf season!

This was the beginning of CDTCI.

Tom's sole purpose in founding and funding CDTCI (a federally registered not for profit corporation) is to help diabetics and others across Canada get what they are entitled to and more - all at a reasonable cost. Maneuvering through CRA and your medical team is daunting for most and often riddled with roadblocks, misinformation and delays. Our small but effective team has now perfected the process through trial and error and sheer determination. You can't lose with CDTCI! If you want to go it alone, go for it. Just remember, the first time Tom tried for the DTC, it took him well over 60+ hours, tons of frustration and he got declined! Don't let that happen to you.

FAQ's about CDTCI and DTC's

Heading

Heading

Heading

Numbers Prove The Results We Can Get

The chart below is from Diabetes Canada's reported numbers in 2021. The government will not disclose how many T1 diabetics are currently approved and claiming their DTC but we "guesstimate" based on anecdotal evidence that fewer than 5% of eligible T1 diabetics are getting their legitimate, legal government entitlement. Act now and start receiving your DTC benefits. DTC's are waiting for you to take action, get approved and then take advantage of this government programme for the rest of your life.

The government has approved DTC's for Type 1 diabetics; however, they won't chase you down to make sure you apply and claim your benefits.

You must initiate the application.

Get in touch now so we can help you get what you are owed.

5.7 Million

Canadians diagnosed with either T1 or T2 diabetes

300,000 to 500,000

Estimated T1 diabetics in Canada

Not Reported

The number of T1's currently with DTC approval and receiving their credits. CDTCI guesstimates less than 5%.

Here's What People Are Saying...

Daniel P.

Milton, ON CA

I have known the founder for most of my life. He was my AAA hockey coach when I was first diagnosed in 1999 and for many years after. In hindsight, what a bonus that was...having a T1 Hockey Coach telling my parents I was now a T1 Goalie! When Tom brought this programme to my attention recently, I had been to my endo three times since this awesome, mostly unknown, announcement in June, 2022 and NOT ONCE was it brought up at my appointments! Now I will get a nice big tax refund for my 2021 and 2022 taxes plus keep getting refunds each year for a long time.'' We are currently looking at going back even more years for my DTC's. CDTCI says, despite the challenges and complexity of the application, I should definitely do it!!!

Sarah L.

London, ON CA

I found out about CDTCI through a Google search when looking for help with the costs of diabetes. Both my son (age 7) and I have Type 1 Diabetes. As you can imagine, it is a real daily struggle and very, very expensive. We have both recently applied for our refunds with CDTCI and are now waiting for CRA to approve.'' The money we will save and get back as a refund from the government will be a big step in helping our family now and for our future. We are looking at a total refund of over $9,000 and this is for just 2021 and 2022. We will definitely be applying for previous years once this application is complete. This will change everything for us.

Reasons Why You Need Your DTC Approved!

Get or save thousands, even hundreds of thousands of tax dollars over your lifetime.

Reduce stress and costs of living with T1 diabetes

Peace of mind and a better life ahead for you